The Art of Investment

Introduction:

Investing is an essential aspect of building wealth and achieving long-term financial goals. Whether you're a seasoned investor or just starting out, understanding the principles of investment is crucial for success. In this blog post, we will delve into the world of investment, exploring key concepts, strategies, and tips to help you make informed decisions and grow your wealth over time.

1. Setting Financial Goals:

Before embarking on your investment journey, it's important to define your financial goals. Are you saving for retirement, planning to buy a house, or looking to fund your child's education? Clearly outlining your objectives will help you determine the investment horizon, risk tolerance, and asset allocation that align with your aspirations.

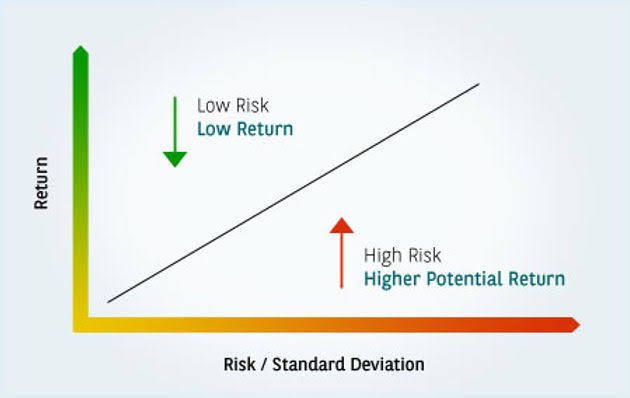

2. Understanding Risk and Return:

Investing inherently involves risks, and understanding the relationship between risk and return is crucial. Generally, investments with higher potential returns carry higher risks. It's essential to assess your risk tolerance level and strike a balance between risk and return that suits your comfort zone and long-term goals.

3. Diversification:

Diversification is a fundamental strategy to mitigate risk in an investment portfolio. By spreading your investments across different asset classes, sectors, and geographical regions, you reduce the impact of any single investment's poor performance on your overall portfolio. Diversification can be achieved through various investment vehicles such as stocks, bonds, mutual funds, real estate, and more.

4. Investment Vehicles:

There are numerous investment vehicles available, each with its own characteristics and risk profiles. Here are a few common investment options:

a. Stocks:

Investing in individual company stocks allows you to become a partial owner, sharing in the company's success or failure.

b. Bonds:

Bonds are debt securities issued by governments or corporations. They provide fixed interest payments over a specified period.

c. Mutual Funds:

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets, managed by professional fund managers.

d. Real Estate:

Investing in real estate involves purchasing properties with the aim of generating rental income or selling them for a profit.

e. Exchange-Traded Funds (ETFs):

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks, offering diversification at a lower cost.

5. Investment Strategies:

There are various investment strategies that investors employ based on their goals, risk tolerance, and market conditions. Some popular strategies include:

a. Buy and Hold:

This strategy involves selecting quality investments and holding them for the long term, riding out short-term market fluctuations.

b. Dollar-Cost Averaging:

With this approach, investors regularly invest a fixed amount of money, regardless of market conditions, buying more shares when prices are low and fewer shares when prices are high.

c. Value Investing:

Value investors seek out undervalued stocks or assets in the market, with the expectation that their true value will be recognized over time.

d. Growth Investing:

Growth investors focus on companies with strong growth potential, even if their current valuation seems high, betting on future earnings and expansion.

6. Regular Monitoring and Rebalancing:

Investing is an ongoing process that requires regular monitoring and review. Market conditions change, and your financial goals may evolve over time. It's essential to assess your portfolio's performance, rebalance your holdings if necessary, and make adjustments to ensure it remains aligned with your objectives.

Conclusion:

Investing is a powerful tool for growing wealth, but it requires careful planning, research, and a long-term perspective. By understanding your financial goals, managing risk, diversifying your portfolio, and employing suitable investment strategies, you can navigate the investment landscape with confidence

"How To Get Rich With Bitcoin Investing Even If You Have No Clue About Technology"

Click HERE To Know More

⬆️⬆️⬆️⬆️⬆️⬆️⬆️⬆️⬆️⬆️ = 🤑🤑🤑🤑🤑

Comments

Post a Comment