Navigating the World of Loans and Credit: Your Comprehensive Guide

Introduction:

In today's modern financial landscape, loans and credit play a significant role in shaping our personal and professional lives. Whether you're purchasing a new home, starting a business, or funding your education, understanding the fundamentals of loans and credit is crucial for making informed financial decisions. This comprehensive guide aims to demystify the world of loans and credit, providing you with the knowledge and tools needed to navigate this complex terrain.

Table of Contents:

- Definition and Types of Loans

- Secured vs. Unsecured Loans

- Installment Loans vs. Revolving Loans

- Definition and Importance of Credit

- Credit Score and Credit Reports

- Factors Affecting Credit Scores

- Credit Cards

- Personal Loans

- Auto Loans

- Mortgages

- Student Loans

- Assessing Your Needs

- Researching Lenders and Loan Options

- Gathering Required Documentation

- Submitting the Application

- Approval and Disbursement

- Budgeting and Financial Planning

- Making Timely Payments

- Monitoring Credit Utilization

- Minimizing Debt and Avoiding Defaults

- Paying Bills on Time

- Reducing Credit Card Balances

- Limiting Credit Applications

- Regularly Checking Credit Reports

- Structuring Repayment Plans

- Accelerating Loan Payoff

- Refinancing and Loan Consolidation

- Seeking Professional Advice

- High-Interest Rates

- Predatory Lending Practices

- Debt Traps and Overborrowing

- Negative Impact on Credit Scores

- Responsible Credit Card Usage

- Diversifying Credit Types

- Keeping Credit Utilization Low

- Building a Long Credit History

10. Conclusion

Section 1: What are Loans?

Loans are financial arrangements in which a lender provides a specific amount of money to a borrower, who agrees to repay the loan amount over a predetermined period. Loans can be categorized into various types based on their purpose, terms, and repayment structure.

- Secured Loans

Secured loans are backed by collateral, such as a home or vehicle, which the lender can seize if the borrower defaults on the loan.

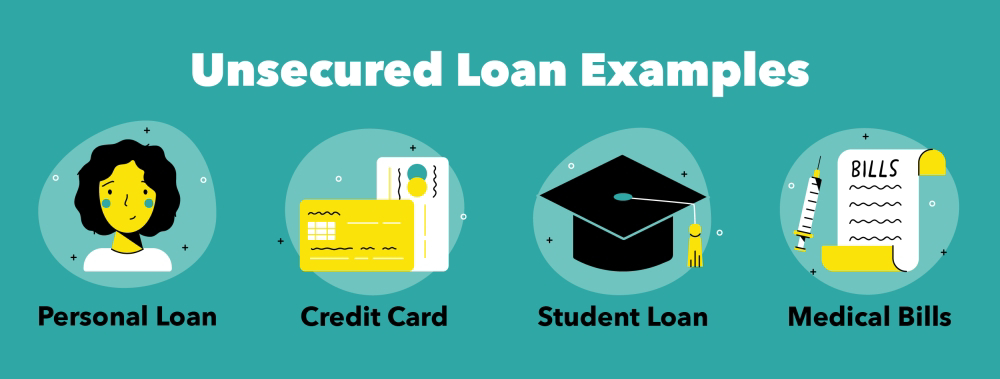

- Unsecured Loans

Unsecured loans, on the other hand, do not require collateral but typically have higher interest rates to compensate for the increased risk to the lender.

- Installment Loans vs. Revolving Loans

Furthermore, loans can be either installment loans or revolving loans. Installment loans involve borrowing a fixed amount and repaying it in regular installments over a specified period. Revolving loans, such as credit cards, provide a maximum credit limit, and borrowers can use and repay the borrowed amount as needed.

Section 2: Understanding Credit

Credit refers to a borrower's ability to access funds with the understanding that they will be repaid at a later date. Establishing and maintaining good credit is vital for obtaining favorable loan terms and interest rates. Creditworthiness is assessed through credit scores and credit reports.

- Credit Score and Credit Reports

A credit score is a numerical representation of an individual's creditworthiness, typically ranging from 300 to 850.

- Factors Affecting Credit Scores

It considers factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit applications. Credit reports, compiled by credit bureaus, provide detailed information about an individual's credit history, including loans, credit cards, and payment patterns.

Section 3: Different Types of Credit

Credit comes in various forms, each tailored to specific financial needs. Understanding the different types of credit can help you choose the most suitable option

Credit Cards:

Revolving credit lines that allow you to make purchases up to a predetermined limit. Balances can be paid in full or carried over, accruing interest on the unpaid amount.

Personal Loans:

Unsecured loans with fixed interest rates and repayment periods. These can be used for a variety of purposes, such as debt consolidation, home improvements, or major purchases.

Auto Loans:

Loans specifically designed for purchasing vehicles. They are secured by the vehicle itself and typically have fixed interest rates and terms.

Mortgages:

Loans used to finance the purchase of real estate. They are often long-term commitments, spanning 15 to 30 years, and involve collateral in the form of the property being purchased.

Student Loans:

Loans designed to finance education expenses. These can be obtained through the government or private lenders, with varying interest rates and repayment options.

Section 4: The Loan Application Process

When applying for a loan, it is essential to follow a systematic approach:

Determine the purpose of the loan, the amount required, and your ability to repay it. Consider factors such as interest rates, fees, and repayment terms.

Compare offerings from various lenders, considering their reputation, interest rates, fees, customer service, and eligibility criteria.

Prepare necessary documents, such as identification, income verification, employment history, bank statements, and any collateral information, if applicable.

Fill out the loan application accurately and provide the required documentation. Double-check the application to ensure accuracy before submission.

E. Approval and Disbursement:

The lender will review your application, credit history, and financials. If approved, you will receive the loan agreement outlining the terms. After signing, the funds will be disbursed.

Section 5: Managing Credit Responsibly:

Using credit responsibly is crucial for maintaining financial stability and a positive credit profile. Consider the following tips:

Budgeting and Financial Planning:

Create a budget to manage your income and expenses effectively. Prioritize debt repayment and save for emergencies.

Making Timely Payments:

Pay your bills and loan installments on time to avoid late payment fees and negative impacts on your credit score.

Monitoring Credit Utilization:

Keep your credit card balances low in relation to your credit limit. A high credit utilization ratio can negatively affect your credit score.

Minimizing Debt and Avoiding Defaults:

Aim to minimize your overall debt and avoid defaulting on loans or credit card payments. Defaulting can lead to severe consequences, such as damaged credit, legal action, and collections.

Section 6: Improving Credit Scores

If you have a less-than-ideal credit score, don't despair. There are steps you can take to improve it over time:

Paying Bills on Time:

Consistently making on-time payments demonstrates financial responsibility and positively impacts your credit score.

Reducing Credit Card Balances:

Aim to pay down credit card balances to lower your credit utilization ratio and improve your creditworthiness.

Limiting Credit Applications:

Each credit application generates a hard inquiry on your credit report, which can temporarily lower your credit score. Apply for credit judiciously.

Regularly Checking Credit Reports:

Review your credit reports regularly to identify errors or inaccuracies. Dispute any discrepancies promptly to ensure an accurate credit profile.

Section 7: Loan Repayment Strategies

Effectively managing loan repayments can help you save money and pay off debt faster:

Structuring Repayment Plans:

Choose a repayment plan that suits your financial situation. Options include fixed monthly payments, graduated payments, or income

Accelerating Loan Payoff:

Consider making additional payments or increasing your monthly payment amount to reduce the loan term and save on interest.

Refinancing and Loan Consolidation:

Explore the possibility of refinancing your loans or consolidating multiple loans into a single one with more favorable terms.

Seeking Professional Advice:

If you're struggling with debt, consider seeking guidance from financial advisors or credit counseling agencies to explore debt management options.

Section 8: Risks and Pitfalls

While loans and credit offer financial flexibility, there are potential risks to be aware of:

High-Interest Rates:

Some loans, particularly those offered to individuals with poor credit, may carry high interest rates. Assess the long-term costs before committing to such loans.

Predatory Lending Practices:

Beware of lenders who engage in unethical practices, such as exorbitant fees, deceptive terms, or unnecessary add-ons. Research lenders carefully and read loan agreements thoroughly.

Debt Traps and Overborrowing:

Borrowing more than you can reasonably afford can lead to a cycle of debt and financial hardship. Borrow responsibly and avoid overextending yourself.

Negative Impact on Credit Scores:

Late payments, defaults, and excessive debt can damage your credit score. Be mindful of your financial obligations to maintain a healthy credit profile.

Section 9: Building a Healthy Credit Profile:

Building and maintaining a strong credit profile is essential for accessing favorable loan terms and financial opportunities:

Responsible Credit Card Usage:

Use credit cards responsibly, paying balances in full and on time. Avoid maxing out credit cards and keep utilization ratios low.

Diversifying Credit Types:

Maintain a mix of credit accounts, such as credit cards, installment loans, and mortgages. This demonstrates your ability to handle various types of credit responsibly.

Keeping Credit Utilization Low:

Building a Long Credit History:

Establishing a long credit history demonstrates your ability to manage credit responsibly. Avoid closing old credit accounts unless necessary.

Section 10: Conclusion

Understanding the intricacies of loans and credit is crucial for making informed financial decisions. By familiarizing yourself with the various types of loans, credit management strategies, and potential risks, you can navigate this complex landscape with confidence. Remember to borrow responsibly, make timely payments, and prioritize financial stability to build a solid credit profile that opens doors to future opportunities.

Comments

Post a Comment